Background

Countries engaged in international trade and investment have been largely successful at reducing many of the traditional barriers to the flow of goods, such as tariffs. As a result, trade deals are increasingly prioritizing the elimination of unnecessary regulatory differences between trade partners which act as a lingering barrier to trade, creating inefficiencies that unnecessarily raise costs for businesses and consumers.

One important mechanism in successful international regulatory cooperation (IRC) involves efforts by trade partners to provide advanced notice of upcoming regulations that are likely to affect international trade and investment. The U.S. considers this a valuable component of promoting good regulatory practices (GRP) and has tasked its regulatory agencies with flagging such rules in the semiannual Unified Agenda of Regulatory and Deregulatory Actions.

The Office of Information and Regulatory Affairs (OIRA) issued guidance to agencies in 2008 to begin flagging rules in the 2008 Unified Agenda that were expected to have a significant impact on international trade and investment. On May 1, 2012, President Obama reinforced OMB’s directive by issuing Executive Order 13609: “Promoting International Regulatory Cooperation.” Although independent regulatory agencies are not required to comply, they are encouraged to do so as part of GRP.

As of 2008, all executive agencies should be flagging rules in the Unified Agenda that are likely to have a significant impact on international trade and investment. In theory, this also creates an advanced notice system and a forum that U.S. and foreign stakeholders can use to identify upcoming regulations that will likely affect them and participate in the notice-and-comment period.

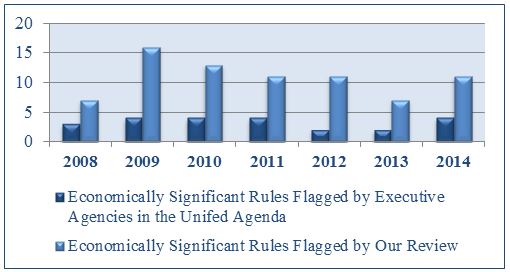

To analyze how well agencies are performing at flagging these rules, the George Washington University Regulatory Studies Center compared the number of economically significant rules that agencies flagged in the Unified Agenda from 2008 through 2014 with the number of rules we identified, based on our criteria, that were likely to have an impact on international trade and investment.

Findings

In general, agencies are missing opportunities to provide advanced notice of upcoming rules with a significant impact on international trade and investment. The highest percentage of success in flagging rules with an international impact occurred in 2008 but was still only 43% of the total that, according to our analysis, should have been flagged for that year. Surprisingly, agencies’ performance appears to have decreased after the issuance of E.O. 13609. Using our criteria, they flagged an average of 34% of total rules affecting international trade and foreign direct investment (FDI) prior to E.O. 13609 and an average of 28% thereafter. Interestingly, agencies did not flag a single rule that we identified as affecting FDI during any of these years.

Our analysis also demonstrates that there is significant variation among executive regulatory agencies in their performance in flagging rules. For example, the Department of Transportation (DOT) flagged around 80% of rules identified using our criteria while the Environmental Protection Agency (EPA) flagged 20% and the Department of Energy (DOE) flagged about 5%.

Independent regulatory agencies did not flag major rules in the Unified Agenda following OMB’s 2008 guidance, and only the Federal Deposit Insurance Corporation (FDIC) has flagged major rules likely to have a significant impact on international trade and investment after E.O. 13609.

Recommendations

- Expanded input from domestic and international stakeholders during notice-and-comment periods could aid agency efforts to better project costs, be more aware of additional international standards they might consider, and avoid duplicative or unnecessary regulations.

This research is funded in part by the European Union.

Related Content:

Working paper, Identifying Regulations Affecting International Trade and Investment: Better Classification Could Improve Regulatory Cooperation, by Daniel R. Pérez, November 10, 2015

VIDEO: Identifying Regulations Affecting International Trade & Investment: Better Classification Could Improve Regulatory Cooperation from GW Regulatory Studies Center on Vimeo.