Download this Commentary (PDF)

This year marks the fortieth anniversary of two major pieces of federal deregulatory legislation. The Motor Carrier Act of 1980 removed rate and route regulations in the U.S. trucking industry, and the Staggers Rail Act of 1980 deregulated most freight rail rates. Two years earlier, Congress passed and President Carter signed bills that gradually deregulated airlines and natural gas, opened electricity generation to entry by cogenerators, and legalized home brewing, which had been illegal since Prohibition. Subsequent initiatives deregulated intercity buses and crude oil prices and introduced further competition in electric generation and natural gas. By the mid-2000s, 13 states and the District of Columbia even introduced competition in retail electricity sales.

I believe we should draw three related lessons from this major wave of regulatory reforms: (1) Intentions do not equal results, (2) Facts are stubborn things, and (3) We can make progress together on policy if we focus on evidence. These are not the usual lessons people talk about regarding deregulation; they do not necessarily support a particular policy position. Instead, they are epistemic lessons – that is, they relate to the role of knowledge in the policymaking process.

1. Intentions do not equal results.

The Airline Deregulation Act of 1978 set the stage and helped build support for many subsequent regulatory reforms in other industries. One major finding that emerged from scholarly research and the hearings of Sen. Ted Kennedy’s Administrative Practices Subcommittee was that regulation by the Civil Aeronautics Board (CAB) was not even accomplishing its professed goal of stabilizing airline industry profits.

Airline competition was believed to be unstable, and so the CAB severely limited entry on individual airline routes and regulated air fares. These regulations failed to protect airline profits, because airlines dissipated the profits through nonprice competition. One significant, wasteful form of competition involved scheduling an excessive number of flights, with the result that the average airplane flight was only half full. (See Stephen Breyer’s Regulation and Its Reform for more details.)

More creative frills also abounded. For example, a TWA ad from 1968 touts four types of “foreign-themed” flights between U.S. cities – Italian, French, Olde English, and “Manhattan Penthouse.” (Apparently Manhattan sounded sufficiently exotic in 1968 to qualify as foreign.) The themed flights featured “Foreign music. Foreign magazines and newspapers. Foreign touches all around. And the best in foreign cuisine.” And, of course, flight attendants dressed to match each theme. Despite the promised foreign cuisine, the ad also reassures readers, “Yes, you may still enjoy a steak cooked to order. That’s a TWA specialty.”

Deregulation exposed most of this nonprice competition as wasteful. Airlines could have continued to offer high fares, empty seats, and frills, but competition revealed that most passengers were willing to lose the frills and put up with more crowded flights in exchange for lower fares.

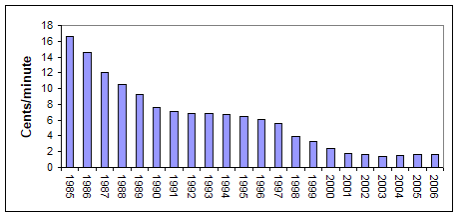

Another example of intentions not guaranteeing results is the cross-subsidization of local wireline telephone rates with per minute charges on long-distance rates. Historically, regulators sought to subsidize local wireline phone service to ensure that every household would be connected to the telephone network. Before the 1984 AT&T breakup, regulators kept local phone rates low by assigning an ever-growing portion of the costs of the wireline phone network to interstate service. The breakup forced AT&T to shed its local phone companies, so the Federal Communications Commission (FCC) developed an explicit subsidy system of per minute charges on long-distance calls that local wireline phone companies would collect from AT&T and the other long-distance companies. As the graph below shows, these charges averaged more than 16 cents per minute in 1985. Long-distance companies simply passed them on to customers as part of the per minute charge for long-distance service.

Per Minute Charges on Long-Distance Phone Service, 1985-2006

Data source: FCC, Telecommunications Industry Revenues, various years.

The subsidies failed to achieve the goal of increasing local phone subscribership. The elasticity of demand for local phone service was very low, so subsidizing local phone service did little to increase telephone subscribership. At the same time, many households’ decision to get a telephone was sensitive to the price of long-distance service. By increasing the price of long-distance service, the per minute charges actually discouraged some people from getting a telephone connection at all. They could “afford” to have a phone, but it was too expensive to use! Fortunately, the FCC recognized the inefficiencies associated with per minute charges and gradually reduced them, adopting a rule to phase them out completely in 2011. Taking the demand both for local and for long-distance service into account, Jerry Hausman, Timothy Tardiff, and Alexander Belinfante estimated that when the FCC reduced per minute charges between 1984 and 1990, telephone subscribership actually increased by 0.45 percent, or 450,000 households.

These regulations failed to produce the intended outcomes despite policymakers’ good intentions. For this reason, decision-makers should have evidence that a potential regulation is actually likely to accomplish the intended goal before they decide to regulate. Surely that’s something that both proponents and opponents of regulation ought to be able to agree upon.

2. Facts are stubborn things.

Price and entry regulations in many industries were predicated on the assumption that the industry was a “natural monopoly,” meaning that it is less expensive for one firm to serve the entire market than for multiple firms to do so. Empirical research and experience, however, have often demonstrated that competition is possible in industries that were assumed to be natural monopolies.

Numerous dramatic examples occur in the communications industries. In the 1970s and early 1980s, local governments awarded monopoly rights (“franchises”) to cable TV companies under the assumption that cable TV was a natural monopoly. But when Thomas Hazlett actually gathered data on cable system performance in jurisdictions that had competing cable systems, he found that competition produced lower prices and a larger selection of channels. Other scholars and government economists replicated these findings (summarized in this article by Jerry Brito and me), and the Telecommunications Act of 1996 made competition in cable TV national policy. Similarly, competitive entry demonstrated that neither long-distance telephony, nor local wireline telephony, nor wireless telephony, nor broadband are natural monopolies.

Local electric distribution wires may be one of the industry segments most likely to be a natural monopoly. Nevertheless, empirical research by Walter Primeaux Jr. and (former GW professor) John Kwoka found that in the small number of U.S. cities with competing local electric distribution companies, costs and prices were lower than in similar cities with monopoly distribution companies.

These results do not mean that stubborn facts always show monopoly is never a problem. In the freight rail industry, one of the most stubborn facts policymakers must address is that a minority of shippers have no realistic transportation alternative to a single railroad, even though the majority of shippers have competitive options. The Staggers Act of 1980 deregulated most rail rates but gave the Interstate Commerce Commission (ICC) authority to regulate a rail rate if the shipper has no alternatives to a single railroad and regulators find that the rate is unreasonable. The Surface Transportation Board, which inherited the ICC’s regulatory duties when the ICC was abolished in 1995, is still struggling to develop rate procedures that make rate relief accessible to all captive shippers without creating a slippery slope back toward pre-1980 rate regulation, which produced deteriorating rail service and widespread railroad bankruptcies.

Forty years may seem like a long time to solve the captive shipper problem, but that may be an under-estimate. Darius Gaskins, who promoted deregulation as ICC chairman in 1980-81, wrote in 2008 that this problem “still has not been solved to everyone’s satisfaction after 150 years of effort.”

Some stubborn facts tell us where regulation is necessary, and some tell us where it is not necessary.

3. We can make progress together on policy if we focus on evidence.

To say that today’s political and policy environment is contentious is an understatement. Commentators have outdone themselves in dredging up superlatives to describe the dysfunction created by political discourse characterized by excessive use of superlatives. Many yearn nostalgically for a time not so long ago “When Politics Worked,” and policymakers with very different political philosophies could still put their heads together to solve pressing problems.

Economic regulatory reform was almost always accomplished in this way. I believe this occurred because policymakers focused on the actual outcomes produced by regulation, instead of personal attacks, name-calling, and sensationalism.

Once again the hearings held by Sen. Ted Kennedy’s Administrative Practices Subcommittee on airline regulation are a prime case in point. Justice Stephen Breyer, who planned and oversaw the hearings as a special counsel to the Judiciary Committee, wrote in chapter 1 of this book that “The primary function of the hearings was to gather information that would resolve the vast majority of the issues. After the hearings, this information would be used to compile a comprehensive report. Legislators would be likely to follow the report’s recommendations only if they found it to be thorough and fair, with the objections to and the benefits of reform seriously weighed.” So, for example, an entire day of hearings was spent examining intrastate air fares in California and Texas, which were only 50-70 percent of the fares charged on CAB-regulated routes of similar distance.

Breyer elaborated on the subcommittee’s approach in a 2008 interview:

What was somewhat surprising but very important is we stayed away from things that—let’s call it “the frozen dog.” We found instances where they’d carry the dog on the airplane and it would come off frozen … That gets on the front page of the newspaper. Don’t do it. Resist it. Limit it. Of the days of airline hearings, we had one day—what we called “the consumer day”—devoted to that kind of thing. But five of the six were devoted in a systematic way to a serious investigation of: How do you set rates? How do you set routes? What do you do about enforcement? What is the theme here?

It was like a theater. But it was like theater that’s not superficial. Beneath each movement on the stage is an enormous amount of substantive material backing up the question that’s asked.

And observers noticed. In The Politics of Deregulation, Martha Derthick and James Quirk recount the reaction of David Burnham, who covered the hearings for the New York Times. Burnam “covered the hearings in great depth because, as he later told an interviewer, they were ‘really aimed at substance’ – ‘solid stuff’ as opposed to mere scandalmongering.”

Another prime example of evidence-based analysis is the classic 1973 Yale Law Journal article on economic regulation by Mark Green and Ralph Nader, subtitled “Uncle Sam the Monopoly Man.” In a measured, scholarly tone, this article recounts the leading empirical economic research of the day that showed how economic regulation increased costs, increased prices, and wasted resources. In just 20 pages, the article cites more than 30 leading regulatory and industrial organization economists (as well as a number of legal scholars well-versed in economics), a dozen articles in refereed economics journals, and two dozen scholarly books on regulation. (In contrast to today’s norms in the economics profession, a surprisingly large proportion of the empirical research on economic regulation at that time was published in books rather than journals.) The article includes a table showing empirical estimates from the academic literature of the costs created by ICC, CAB, Federal Maritime Commission, and FCC regulation.

Green and Nader’s article of course advocates particular policy changes, but it does so based on empirical evidence of economic regulation’s actual outcomes. Policy advocates of all stripes would be well advised to lay off the tweets for a couple hours and instead spend that time considering how they could advance substantive, civil discourse employing this article as a model. Likewise congressional oversight committees could learn a lot from the evidence-based focus of the Kennedy airline hearings.

These three lessons from economic deregulation can help chart a course back to more civil and productive discourse on today’s policy problems.