Originally published in the Brookings Institution's Series on Regulatory Process and Perspective.

Congressional oversight of the regulatory process tends to be criticized for its anemia, but there are signs that Congress does sometimes engage in subtle and complex oversight techniques. One under-studied example of this arises under a 1996 statute called the Congressional Review Act (CRA) and hinges on the work of the U.S. Government Accountability Office (GAO). Known more for its role as an auditor, GAO has created a role for itself as a referee in an increasingly important part of the administrative state.

The Congressional Review Act

The CRA gives Congress fast-track procedures to disapprove a rule within a prescribed window of time after it is issued by a federal agency. A member of the House or Senate can enter a resolution for disapproval during this window and the resolution can be expedited through Congress, avoiding, for example, filibuster in the Senate. Once it is through both chambers, the resolution is presented to the President for veto or signature.

The CRA was used to disapprove a rule only once prior to Donald Trump’s inauguration—for a Clinton administration rule setting workplace ergonomic standards that was disapproved in the early days of the George W. Bush administration. The beginning of Trump’s term saw a sharp uptick in the CRA’s use to disapprove Obama administration rules, resulting in 16 disapproved rules through 2018. (We track these at the George Washington University Regulatory Studies Center.)

The CRA was used to disapprove a rule only once prior to Donald Trump’s inauguration.

Disapproval of a rule under the CRA is most feasible immediately following an election where the White House changes parties and the incoming President is politically in sync with both chambers of Congress. Otherwise, a President would likely veto any congressional resolution to disapprove a rule from his own administration or that of a prior President from his party.[i] But, that window for action can sometimes be reopened if GAO offers a favorable legal opinion, which is a wrinkle that makes CRA disapproval more accessible than is commonly understood.

GAO and the Congressional Review Act

GAO has two roles related to the CRA. The first is written into the law, while the second is something that GAO does of its own accord. First, the CRA requires GAO to report on whether major agency rules have complied with CRA’s procedural requirements. These assessments, which are sent to relevant congressional committees, tend to be fairly dry recitations of what the agencies did or did not do in their rules. GAO churns these out with regularity. What Congress does with these reports upon receipt is unclear, though it’s possible that they occasionally lead to oversight activity.

GAO’s second role under the CRA has largely gone unnoticed. Members of Congress have, from time to time, asked GAO to weigh in on whether an action is a “rule” under the CRA. This is an important distinction because “rules” can be disapproved by Congress under the CRA using the fast-track procedures described above, while actions that are not “rules” cannot.[ii] The definition is technical and depends more on what a document does than what it is called, so it is sometimes unclear whether an agency action is a “rule” or not.

The CRA does not direct GAO to resolve this ambiguity by giving legal opinions, nor does it vest any other particular body with the express authority to determine what a “rule” is under the CRA. An excellent report by Valerie Brannon and Maeve Carey of the Congressional Research Service explains GAO’s role. They point out that “Standing alone, a GAO opinion deciding whether an agency action is a ‘rule’ covered by the CRA does not have legal effect.” As shown below, however, legislators have sought GAO’s legal opinions under the CRA since shortly after it was enacted, suggesting that they attribute political, if not legal, weight to those opinions.

GAO's Record of CRA Legal Opinions

Just five months after President Clinton signed the CRA into law in March 1996, a senator wrote to GAO asking for its opinion about whether a memorandum from the Secretary of Agriculture was a “rule” under the CRA. GAO said yes, reasoning that the memo was a “statement of general applicability and future effect”—a term of art used in the definition of a rule—and not subject to any exemptions.

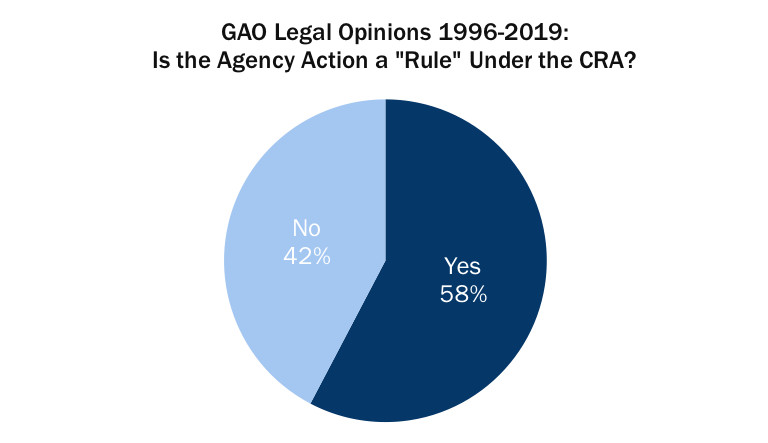

Since that first inquiry in 1996, GAO has offered 25 more legal opinions about whether an agency action was a “rule” in response to inquiries from members of Congress. Across these 26 opinions, GAO opined that the action was a “rule” 15 times, giving reasons for its opinions in detailed letters that are readily available on GAO’s website.

Most of the members’ inquiries have dealt with letters, memos, fact sheets, and other documents that can broadly be described as guidance rather than the “rules” that come out of the notice-and-comment process under the Administrative Procedure Act (APA). One exception was when GAO was asked about the status of a notice of proposed rulemaking, the document that goes out for public comment under the notice-and-comment procedures of the APA; GAO responded that the proposed rule was not a “rule” under the CRA because it was not yet final.

Increased Frequency of Opinions

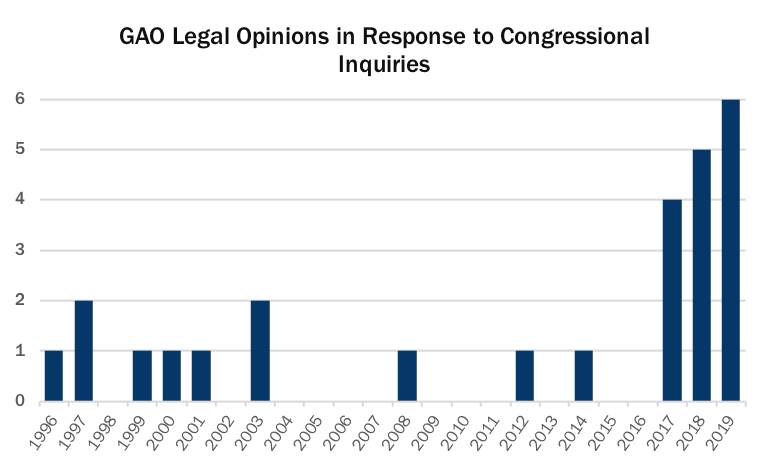

The frequency of GAO’s legal opinions also offers some insight into how Congress uses the tool. GAO issued between zero and two legal opinions in response to inquiries from Members of Congress every year, until there was a significant increase in inquiries in 2017.

As noted above, prior to 2017, only one rule was disapproved under the CRA. The increase in legal opinions in 2017 and beyond is consistent with increased use of the CRA to disapprove rules in the last few years.

When GAO issues a legal opinion that an agency action is a rule, that opinion is not always followed by the introduction of a disapproval resolution. In October 2019, for example, GAO opined that a letter from the Fed was a rule under the CRA. No disapproval resolution has been introduced for it. Earlier in 2019, however, GAO issued a legal opinion that a guidance document issued jointly by the Departments of Health and Human Services and Treasury was a rule under the CRA. Just over two weeks later, a disapproval resolution was introduced in both the House and the Senate. Neither resolution was signed into law.

Future work will explore the relationship, if any, between the disapproved actions and whether they were preceded by GAO legal opinions. That work can help us understand how Congress uses the CRA. The main point here is that while most commentary about the CRA has focused on its relatively infrequent use to disapprove rules prior to 2017, the frequency of GAO legal opinions from 1996 onwards provides one glimpse of Congressional activity involving the CRA that has been occurring below the surface.

Why Does Congress Seek GAO's Legal Opinion?

There are at least four reasons why Congress might ask GAO for its legal opinion about what counts as a “rule” under the CRA: genuine uncertainty, boundary-testing, clock-starting, and signaling.

First, legislators might be genuinely uncertain about how to apply the CRA’s broad definition of a rule to the multitudes of different policy documents that agencies issue. The first legal opinion that GAO offered under the CRA was with respect to a memo from the Secretary of Agriculture about Emergency Salvage Timber Sale Program. In its opinion, GAO explains: “Many agency rules are not described as such. They may be referred to as a guideline, direction, directive, instruction, clarification, manual section, policy, etc. While how an agency describes a document may be considered in determining whether the document is a rule under the APA, the courts primarily consider the substantive effect of the document.”[iii] GAO then explains that whether a document is a rule “requires an examination of what it is intended to accomplish.” If members of Congress want to base its decisions on a careful, fact-intensive analysis, it is reasonable that they would want an expert factfinder like GAO to weigh in.

Second, and relatedly, legislators might also be interested in testing boundaries of the definition of a rule. If the legislator is concerned about a policy document but there might be some disagreement about whether it’s a rule, being able to rely on an expert opinion from GAO could help blunt criticism that the legislator is stretching the law. The example above of a request for a legal opinion about a proposed rule could potentially fall into this category or the one above. In that case, however, GAO opined that a proposed rule is not a “rule” for CRA purposes.

Third, legislators could merely be using GAO’s legal opinions as a procedure to start the CRA clock, even when it does not have a substantive need for an opinion. In this way, Congress can use GAO’s legal opinion to open the window to take action under the CRA. Agencies do not seem to have consistently notified Congress of all rules under the CRA, perhaps relying on a narrower understanding of what was covered by that definition.[iv] The argument is that when GAO determines that a document is a “rule,” the agency should submit it to Congress to start the clock on the fast-track procedures. But, if an agency disagrees with GAO’s opinion, Congress can choose to use the date of the legal opinion to start the clock instead. This was done in 2008, Brannon and Carey report, when an agency declined to submit a policy letter to Congress after GAO issued a legal opinion that the letter was a “rule” under the CRA. A legislator then introduced a disapproval resolution for that letter relying on the GAO legal opinion. More recently, Congress requested and received a GAO legal opinion about an action taken several years prior, effectively re-opening a window long after the action was taken. In this way, a GAO legal opinion can work like a starting gun for a race that started years ago.