Last week, the Internal Revenue Service (IRS) published a final rule setting up a tax penalty—termed an “assessable payment”—for businesses whose employees purchase health insurance through an Exchange using a federal subsidy. The rule, which implements the “shared responsibility” portions of the Patient Protection and Affordable Care Act (ACA), is supposed to act as an incentive for businesses to provide their employees with access to high-quality health insurance. However, some of the provisions for employers are running afoul of the Small Business Office of Advocacy.

In its proposed rule, the IRS stated that the Regulatory Flexibility Act (RFA)—which requires federal agencies to review regulations for their impact on small businesses—did not apply to its proposal “because the regulation does not impose a collection of information on small entities.” However, as Advocacy outlined in its comment to the IRS:

The NPRM [notice of proposed rulemaking] sets forth guidelines that requires [sic] employers to maintain records for a number of calculations and determinations on whether the employers are subject to section 4980H, including but not limited to calculating full-time employees and FTEs [full-time equivalent employees], calculating affordability, and the Form W-2 safe harbor. Therefore, the NPRM imposes a collection of information requirement and the RFA applies to the NPRM.

In its final rule, the IRS contended that the paperwork required by its rule does not require RFA analysis because it merely requires some taxpayers to maintain adequate records to support what they reported on their return, denying Advocacy’s request for analysis of the burdens on small businesses.

Further, while the IRS’s new rule only applies to “applicable large employers,” the agency uses a shockingly low threshold for determining which employers are “large.” Pursuant to statute, businesses with more than 50 employees are considered “large employers,” and may be subject to assessable payments if one or more full-time employees receive a premium tax credit or cost-sharing reduction to purchase health insurance.

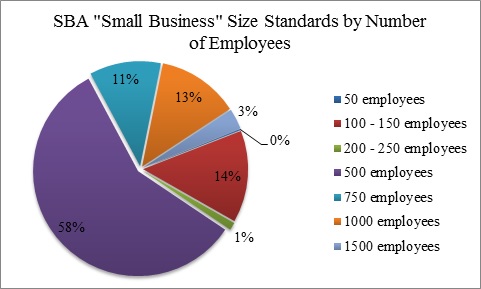

Use of the 50-employee threshold for determining “large employers” diverges from the Small Business Administration’s (SBA’s) definitions of small businesses, and counts many small businesses as “large employers” for the purposes of the IRS’s regulation. As part of its mission, SBA publishes small business size standards for hundreds of industries. Using either the number of employees or average annual receipts, SBA determines which businesses are “small,” and therefore eligible for certain government programs or exempted from certain regulations.

As the above figure shows, according to SBA’s Small Business Size Standards less than 1% of the industries assessed by SBA have a “small business” threshold of 50 employees or fewer. For most of the relevant industries, SBA uses a standard of 500 employees to determine which businesses are “small businesses,” ten times as large as IRS’s standard. In fact, a threshold of 50 employees was only used in one of 509 industries assessed by SBA, showing that the IRS’s 50-employee “large employer” threshold is largely out-of-touch with the small business size determinations used by the rest of the federal government.