Download this Regulatory Insight (PDF)

Introduction

The effects of regulation on jobs have been a heated theme in contemporary political debate. In economic research, the empirical work suggests that regulation plays little role in affecting the aggregate number of jobs in the United States. However, the existing research has mostly focused on the volume or stringency of regulation. Little attention has been paid to regulatory uncertainty, and yet its impact on employment has a basis in the economic theory.

The economic literature generally suggests that increased uncertainty can lead to significant declines in hiring, investment, consumption, and output in the economy. This Regulatory Insight discusses how regulatory uncertainty may affect employment and presents some empirical evidence that increased regulatory uncertainty leads to a temporary drop in aggregate employment. Moreover, the employment effects of regulatory uncertainty are unequal, affecting workers with low levels of education disproportionately.

Real Options and Adjustment Costs

The literature on uncertainty provides theoretical explanations for how uncertainty affects the labor market. Bloom (2014) discusses several channels through which fluctuations in uncertainty can affect economic activity and growth. The channel that delineates a direct linkage between uncertainty and employment is the “real options” effect. The idea is that firms facing increased uncertainty become more cautious about actions like investment and hiring. For example, a firm may have the option to open a new store in an area; however, if the firm is uncertain about the future development plan of the area, it may prefer to wait for greater certainty. Therefore, this channel is also referred to as the “wait-and-see” effect.

Increased uncertainty makes firms more cautious about their decisions because adjustment costs of inputs make it expensive to reverse the decisions. Labor adjustment costs involve costs of recruitment, training, firing (e.g., severance pay), and productivity losses. Those costs are economically significant, estimated to be around 10 to 20 percent of annual wages.

Bloom et al. (2018) develop a dynamic stochastic general equilibrium (DSGE) model that illustrates the real-options effect of uncertainty shocks. In their model, they incorporate time-varying uncertainty, heterogeneous firms, and nonconvex adjustment costs in both capital and labor into an otherwise standard real business cycle model, which implies that increased uncertainty makes it optimal for firms to wait. The adjustment costs of labor lead to a “Ss” hiring policy rule: firms do not hire until productivity reaches an upper threshold (the S in Ss) and do not fire until productivity hits a lower threshold (the s in Ss). Higher uncertainty increases the hiring threshold and reduces the firing threshold, thereby widening the range of inaction. As a result, net hiring falls due to labor attrition (i.e., workers retire or resign without being replaced).

Empirical studies examining the relationship between uncertainty and employment have also found that an increase in uncertainty leads to a decrease in employment or an increase in unemployment. In addition to aggregate economic uncertainty, the existing literature has also explored how specific types of uncertainty affect the labor market. For example, Rich and Tracy (2004) construct measures of inflation uncertainty and find a significant negative relationship between inflation uncertainty and labor contract duration. Koirala and Ma (2020) show that, both in aggregate and by sector, oil price uncertainty contributes to the negative effects of oil price shocks on employment growth.

Some studies also incorporate heterogeneity in labor when considering adjustment costs, suggesting that the costs are different for workers with different characteristics. For example, it is more costly for firms to search for, hire, and train workers with advanced technical skills who are usually in shorter supply. The heterogeneous labor adjustment costs imply unequal real-options effects of uncertainty on employment with high and low levels of education. With increased uncertainty, firms are more reluctant to adjust the labor with higher education levels because the associated costs to reverse the actions are higher. Consequently, employment with lower education levels is likely to be more sensitive to an uncertainty shock. Sakutukwa and Yang (2018) provide empirical evidence in their analysis with a measure of macroeconomic uncertainty, which suggests that the uncertainty measure predicts the growth rate of employment with lower than a college degree relatively better than employment with a college or higher degree.

Regulatory Uncertainty

Similar to other types of uncertainty, regulatory uncertainty can have a real-options effect on hiring and investment. For example, a pharmaceutical company may choose to wait to develop a new drug if it is uncertain whether the drug would be approved by the regulator.

Policy-related uncertainty has gained increasing attention during recent years. A key contribution is made by the economic policy uncertainty (EPU) index developed by Baker et al. (2016). They construct the index based on the frequency of newspaper articles that contain terms related to economy, uncertainty, and policy. Their empirical analyses using the EPU index find that policy uncertainty shocks reduce employment, investment, and output, both at the firm and macro levels. Numerous studies have been published subsequently to develop similar news-based measures of policy uncertainty for other countries and for specific policy areas such as trade policy and monetary policy.

Comparatively, uncertainty surrounding regulatory policy has not been sufficiently studied or systematically tracked. Baker et al. (2016) build a categorical EPU index on regulation, but the measure is based on a limited set of terms to identify regulation-related news articles and has a clear emphasis on financial regulation.

In ongoing research, Tara Sinclair and I construct a new measure of regulatory uncertainty using text analysis of news articles from seven major U.S. newspapers. We identify regulation-related news content based on a large set of terms extracted from rule titles and assess the degree of uncertainty in the news content using a natural language processing technique. The resulting monthly index tracks regulatory uncertainty in the U.S. from January 1985 to August 2020.

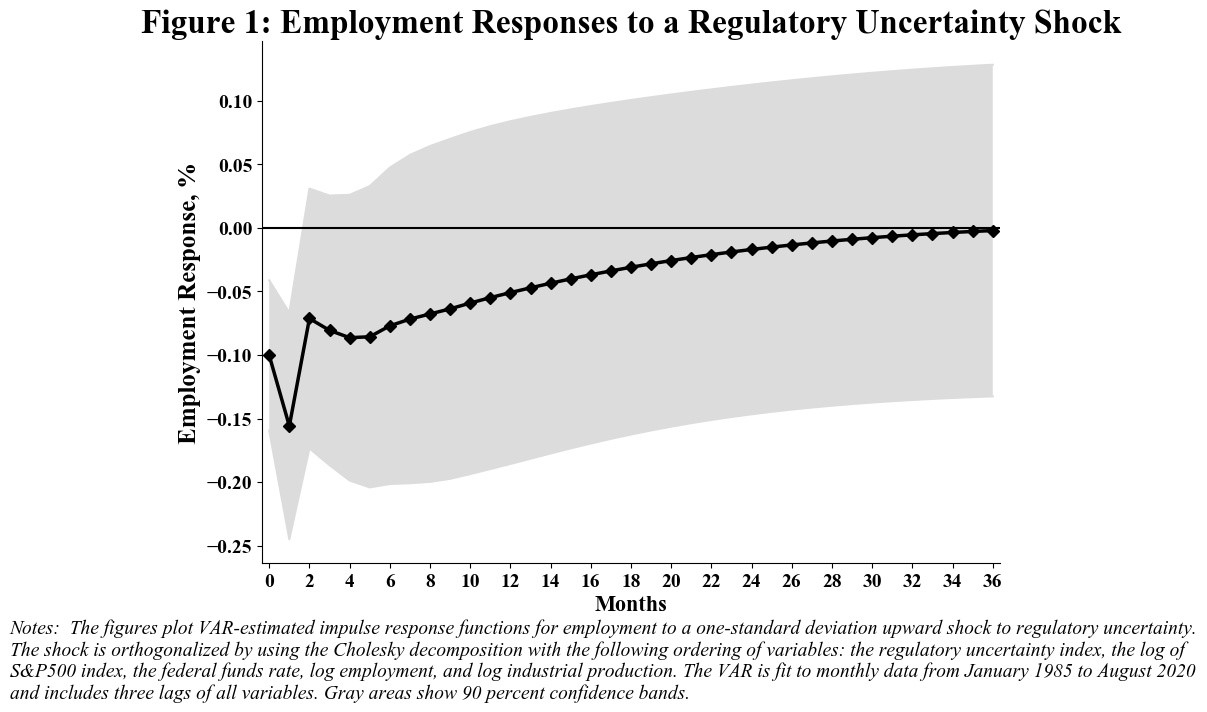

We employ vector autoregression (VAR) with the regulatory uncertainty index to estimate how macroeconomic outcomes respond to regulatory uncertainty shocks. The analysis suggests that a regulatory uncertainty shock leads to a moderate, transitory drop in total employment in the U.S. economy. Figure 1 plots the VAR-estimated impulse response functions. It shows how total employment responds to a one-time upward regulatory uncertainty shock in future time periods following the shock. The effects are statistically significant at the 10 percent level during the first two months after the shock and then slowly vanish after that. The maximum estimated drop in employment in response to the shock is 0.16 percent.

Unequal Employment Effects

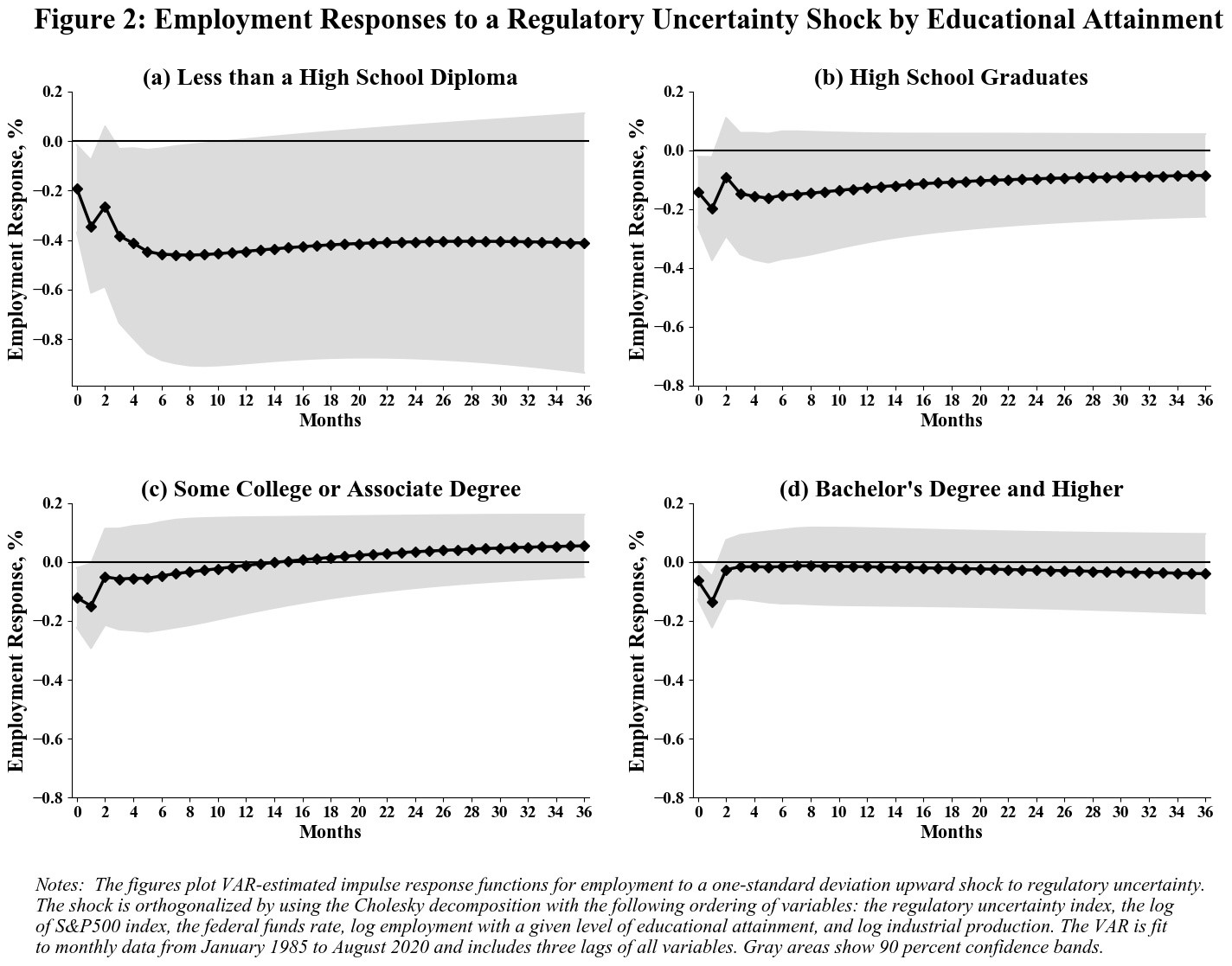

Using the regulatory uncertainty index from our work, I further extend the empirical analysis to examine how regulatory uncertainty affects employment of individuals with different education levels. I use the monthly employment data from the Current Population Survey. The data cover employment levels (25 years old and over) in four education categories: less than a high school diploma, high school graduates (no college), some college or associate degree, and bachelor’s degree and higher.

Figure 2 plots the impulse response functions for employment with different levels of educational attainment. The results suggest that employment with lower levels of educational attainment is more sensitive to regulatory uncertainty shocks. Panel (a) of Figure 2 indicates that a regulatory uncertainty shock leads to a significant drop in employment of individuals with less than a high school diploma up to 10 months after the shock. This effect is more persistent than the impulse responses of total employment (Figure 1) and employment with other higher levels of educational attainment (Panels (a)-(d) of Figure 2), which only suggest a significant drop within the first two months after the shock.

The magnitude of the estimated drop in employment in response to a regulatory uncertainty shock also decreases as the level of educational attainment increases. The maximum drop in employment with less than a high school diploma is estimated to be 0.46 percent, almost three times larger than the estimated drop in total employment. As shown in Panels (b)-(d) of Figure 2, the estimated maximum drop in employment of high school graduates (no college) is 0.2 percent, employment with some college or associate degree drops by 0.15 percent, and employment with bachelor's degree and higher decreases by 0.14 percent. Clearly, employment at a lower education level declines by a larger amount when regulatory uncertainty increases.

This finding is consistent with the theory on asymmetric labor adjustment costs. The adjustment costs for workers with more education are higher than the costs for workers with less education. Therefore, when regulatory uncertainty increases, firms are more reluctant to adjust the labor with higher education levels. In other words, the real-options effect on employment induced by regulatory uncertainty shocks is stronger for workers with lower education levels.

Conclusion

Economic theory suggests that increased uncertainty has a negative effect on employment through the real-options channel, and this effect is greater for lower educated labor than for higher educated due to heterogeneous labor adjustment costs. Building on my joint work with Sinclair, I extend the empirical analysis and show that the theory applies to regulatory uncertainty. Increased regulatory uncertainty reduces future employment, especially for workers with low education levels.

Political campaigns often call for elimination of “job-killing regulations” or regulatory reform to promote “job creation,” but reducing regulatory uncertainty has rarely been a policy priority. One reason is that regulatory uncertainty is much harder to quantify than the volume or stringency of regulation. Our research provides a news-based approach to address this issue, and more can be done to study the impact of regulatory uncertainty and how to incorporate it into regulatory impact analyses. President Biden issued an executive order in January that underlines the need to “take into account the distributional consequences of regulations.” Given that regulatory uncertainty may disproportionately burden workers with lower education levels, the current administration should monitor uncertainty induced by regulatory changes and explore tools to minimize uncertainty in regulatory policy making.