Download this Commentary (PDF)

The COVID-19 pandemic is hitting the economy hard, as market lockdowns and social distancing orders are disrupting business operations and labor markets. Yet a variety of uncertainties induced by this public health crisis are worsening the economic impact of the pandemic.

The latest data show that uncertainty surrounding government policies reached a historical peak during the past two months. Uncertainty specifically around regulatory policy had a more modest increase compared to other sources of policy uncertainty, but its response may just be temporarily muted by other more immediately salient policies. Increased uncertainty suppresses hiring, R&D, new business formation, and human capital investment. If the rising policy uncertainty persists, the economy may take a prolonged time to recover.

Rising Policy Uncertainty

Uncertainty generally means people’s inability to predict the future. Policy uncertainty involves not only what new policies will emerge, but also how current policies will be interpreted, enforced, and changed. Because policy responses to this unprecedented pandemic are subject to numerous unknown factors (e.g., the spread of the virus, the development of effective vaccines, political decisions, etc.), uncertainty is now particularly relevant.

A widely cited measure of policy uncertainty is the newspaper-based economic policy uncertainty index developed by Baker, Bloom, and Davis. The monthly U.S. economic policy uncertainty index is computed based on the frequency of news articles published in ten major U.S. newspapers that contain one or more terms about “uncertainty,” “economics,” and “policy.”[1] Consequently, the index does not directly measure how government policies are written or implemented. Instead, it reflects “real-time uncertainty perceived and expressed by journalists.” The latest data show that in March 2020 economic policy uncertainty in the U.S. reached its highest level since 1985 and remained high in April, with a substantial proportion of the uncertainty related to COVID-19.

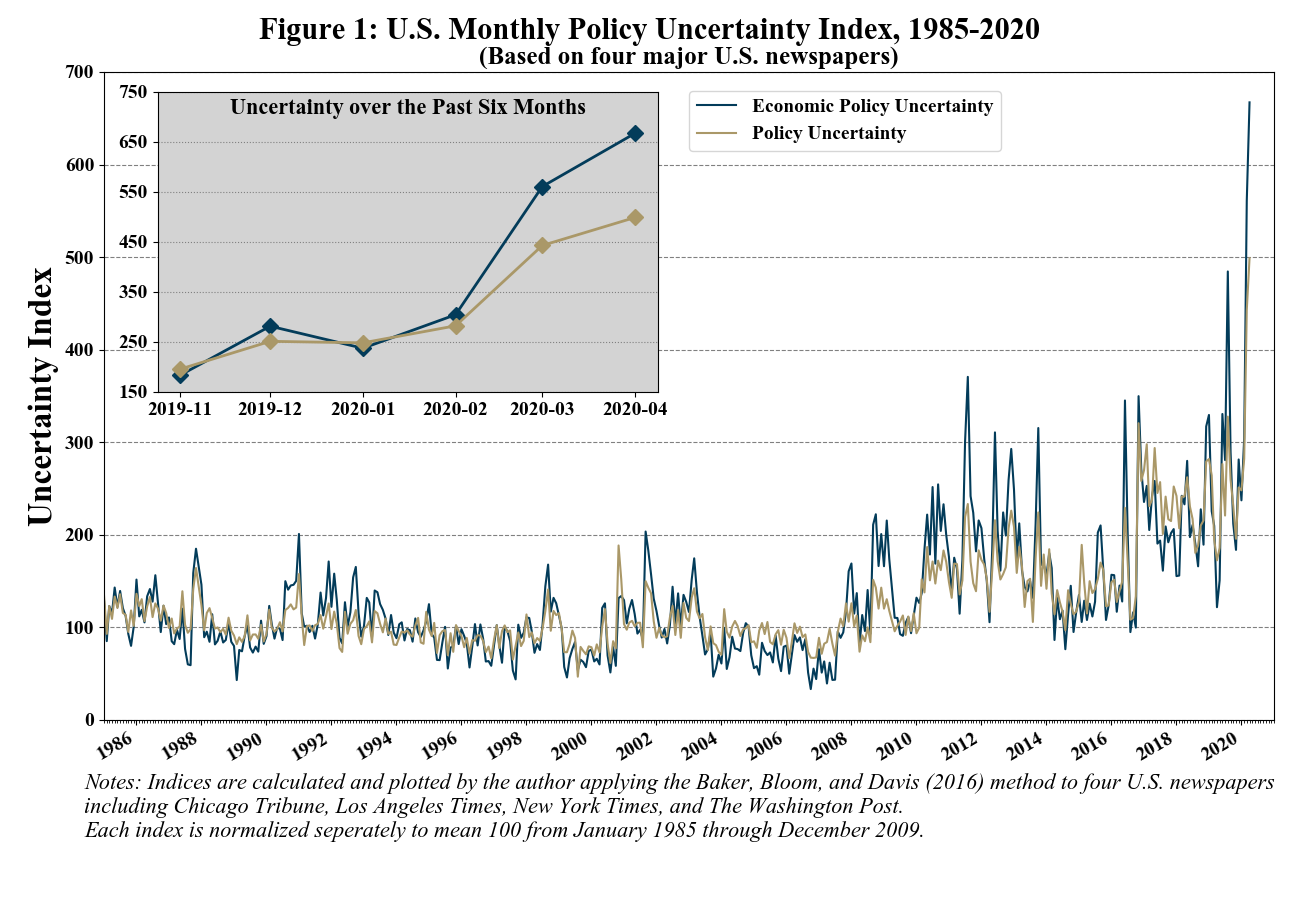

To compare different types of policy uncertainty, I replicated the Baker, Bloom, and Davis measures using four major U.S. newspapers over the same timeframe.[2] Largely mirroring the Baker, Bloom, and Davis index, Figure 1 shows that the monthly economic policy uncertainty estimate increased by 85 percent in March 2020, coinciding with the coronavirus outbreak in the U.S. As of the end of April, the uncertainty continued to increase, reaching a level roughly twice its average in 2019. Figure 1 also tracks a broader measure of policy uncertainty, focused on news coverage related to “uncertainty” and “policy” without limiting it to “economics.” Although the policy uncertainty index demonstrates a slightly lower increase rate than economic policy uncertainty during the past two months, it still reflects an unusually high level of uncertainty compared to the pre-COVID months. This enormous uncertainty shock appears much larger than the ones associated with 9/11 or the 2008-09 financial crisis.

Economic Effects of Uncertainty

Why does increased uncertainty matter? Economic research on business cycles has suggested that uncertainty is strongly countercyclical, meaning that it rises during recessions and falls in booms. While recessions may cause uncertainty to increase endogenously, greater uncertainty can also drive economic slowdown through various channels. One mechanism in which an uncertainty shock can negatively affect economic activity is the “real options” effect, which is also intuitively referred to as the “wait-and-see” effect.

For example, a pharmaceutical company may have the option to invest in the development of a new drug; however, if the company is uncertain about whether the drug would be approved to enter the market by the Food and Drug Administration (FDA), it may prefer to wait until some certainty is achieved. As such, a rise in uncertainty can make firms more cautious about their investment and hiring decisions, especially when the decision cannot be easily reversed. Similarly, uncertainty can postpone household consumption of durables such as housing, automobiles, or home appliances. In aggregate, increased uncertainty leads to significant falls in hiring, investment, consumption, and output in the economy.

This economic effect applies to the current COVID-19 related uncertainty shock. Using an estimated model of disaster effects, a recent study finds that the pandemic implies a year-on-year contraction in U.S. real GDP of 11 percent, with half of the contraction caused by COVID-induced uncertainty.

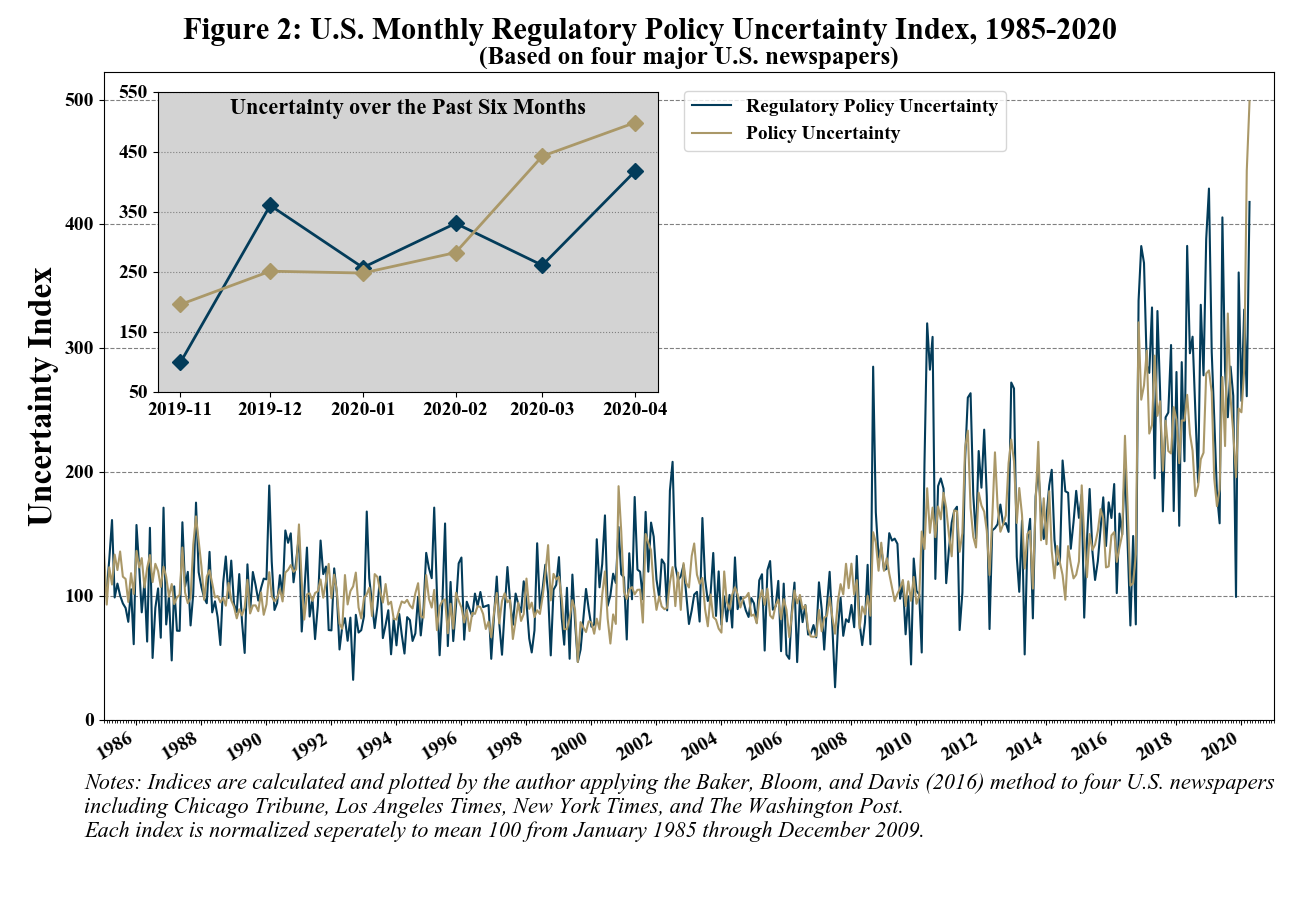

Relatively Muted Regulatory Policy Uncertainty

As a source of policy uncertainty, uncertainty related to regulatory policy is showing a modest, and perhaps lagged, response to the health crisis. As shown in Figure 2, I estimated the regulatory policy uncertainty index using the frequency of news articles with terms related to “uncertainty,” “policy,” and “regulation” as defined by Baker, Bloom, and Davis. As opposed to the significant increase in the economic policy uncertainty and policy uncertainty indices in March, the regulatory policy uncertainty index maintained at its average level of the past year. In April, it rose by 62 percent, which is a large but not unusual increase given the fluctuations in the index during the recent years. The relatively muted regulatory policy uncertainty may be explained by two reasons. First, in response to the coronavirus outbreak, monetary and fiscal policies, lockdown measures, and stay-at-home orders affected people’s lives and business operations in more salient ways. These other policy responses reduced media attention on regulations concerning non-COVID issues such as air quality standards, energy conservation, or autonomous vehicles. Second, although the pace of regulatory activity remained unabated during the pandemic, many of the regulations issued recently are temporary waivers or extensions of compliance with existing regulatory requirements. These temporary relaxations may have added clarifications to the implementation of relevant regulations during the pandemic and thus alleviated the associated uncertainty.

However, a great amount of uncertainty in regulatory policy remains. For example, healthcare companies are uncertain about how FDA will apply its emergency use authorization to their drugs and devices. Travelers are uncertain about when the traveling restrictions to the U.S. will be lifted. Indeed, the historical trend shown in Figure 2 suggests that a spike in policy uncertainty was often accompanied by a substantial increase in regulatory policy uncertainty. Whether regulatory policy uncertainty has peaked or will experience a delayed jump will be revealed as more data becomes available.

[1] For a complete list of terms, see the online appendix of Baker, Bloom, and Davis (2016).

[2] The four newspapers used in the replication include Chicago Tribune, Los Angeles Times, New York Times, and The Washington Post.