Download this Commentary (PDF)

In brief...

The impact of regulatory policy depends on how it is designed and implemented, but public perceptions and subjective attitudes about regulation can also play important roles in how it affects the economy. Using newspaper text, I track sentiment and uncertainty about regulation until January 31, 2021 and discuss how they changed during the Trump and previous administrations in this commentary.

The impact of regulatory policy depends on how it is designed and implemented, but public perceptions and subjective attitudes about regulation can also play important roles in how it affects the economy. In recent research, Tara Sinclair and I used newspaper text to measure sentiment and uncertainty about regulatory policy and examine its macroeconomic impacts. Using the same methodology, I track regulatory sentiment and uncertainty until January 31, 2021 and discuss how they changed during the Trump and previous administrations in this commentary.

Measuring Regulatory Uncertainty and Sentiment

Sinclair and I document the methodology we used for measuring uncertainty and sentiment about regulation in the latest draft of our research paper. To briefly summarize it, our approach composes three parts: (1) we extracted news content related to regulation from seven major U.S. newspapers published since January 1985 using ProQuest’s TDM Studio,[1] (2) we used a dictionary-based “sentiment analysis” method to assess the positive and negative tone (i.e., sentiment) and level of uncertainty expressed in the regulation-related news content of each article, and (3) we constructed regulatory sentiment and uncertainty indexes over time using the sentiment and uncertainty estimates through regressions with time and newspaper fixed effects. When we assessed the sentiment of news content, we used three dictionaries[2] designed for different domains for comparison and robustness checks. The three sentiment indexes based on the three dictionaries demonstrate high correlations. For simplicity, the sentiment index discussed in this commentary is the first principal component of the three indexes.

Regulatory Uncertainty under Trump

Increased policy uncertainty has a negative effect on economic activity. Extensive research suggests that policy uncertainty reduces business investment and employment growth, raises precautionary savings, and increases stock price volatility. Uncertainty around regulatory policy, while less extensively studied, has constantly raised concerns among businesses and scholars.

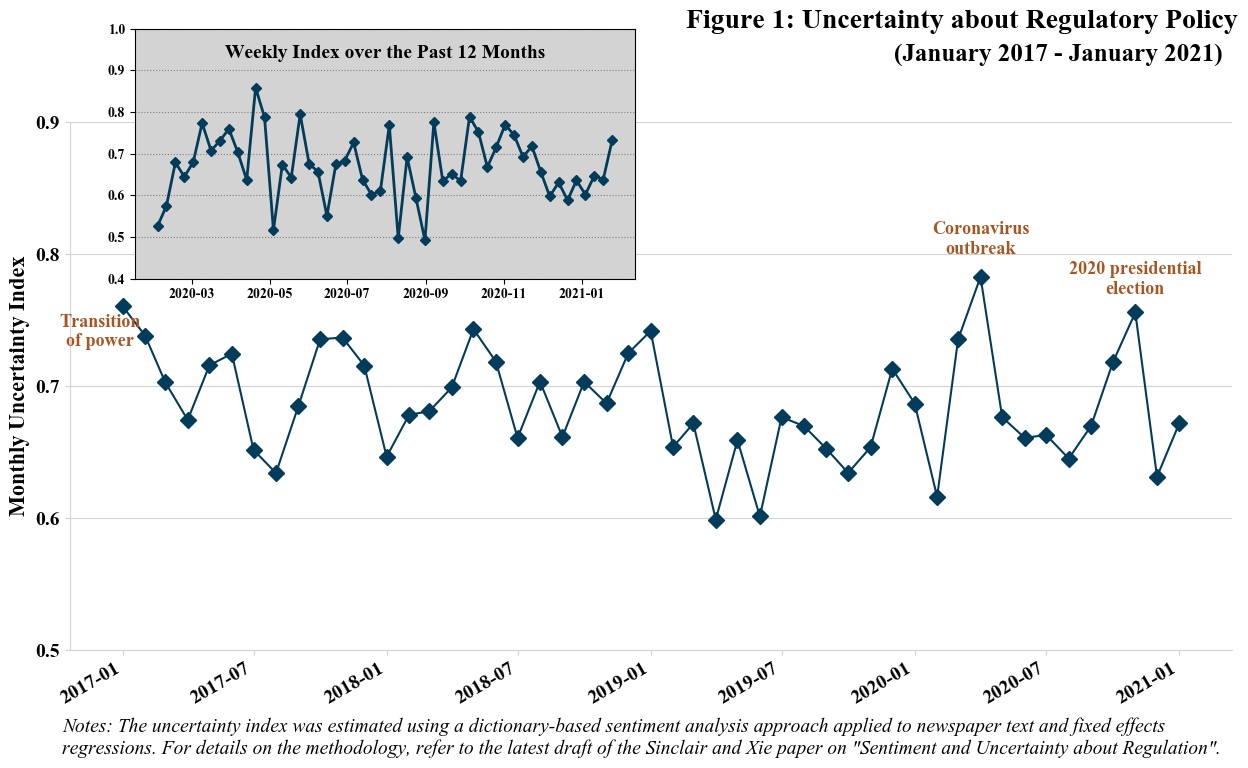

Figure 1 shows the regulatory uncertainty index from January 2017 to January 2021, covering the Trump administration. The largest spikes in regulatory uncertainty occurred in the beginning and end of the administration. It is perhaps unsurprising that policy-related uncertainty rose as a new president took office. As a New York Times article published on February 3, 2017 wrote, “as President Trump gets down to work, investors are now scratching their heads trying to figure out what his presidency will really mean for their portfolios.” In the case of Trump, the increased uncertainty about regulation could be explained by his ambitious deregulatory agenda, including an influential executive order issued in the second week of his presidency setting forth regulatory cost caps and a “two-for-one” requirement for issuing new regulations. The transition to the Biden administration also raised regulatory uncertainty in January 2021, but at a lower level than the 2017 transition.

The regulatory uncertainty spikes in the last year of the Trump administration occurred in April and November 2020, presumably associated with the coronavirus outbreak in the U.S. and the November election. The weekly index over the past 12 months in Figure 1 provides a closer look. Regulatory uncertainty started increasing in the week of March 9 and reached a peak in the week of April 20. The changes in regulatory uncertainty in the early months of 2020 may be related to policy responses to the pandemic such as quarantine orders and travel restrictions. Among the 1,117 news articles published in March and April 2020 that expressed some extent of uncertainty about regulation, nearly 80% of the articles mentioned terms related to COVID-19, and 40% had terms related to COVID-19 appearing in the same section with terms related to regulation. Uncertainty about regulation also remained high in the weeks around November, consistent with the previous research documenting policy-related uncertainty shocks around elections.

Looking over the Trump administration, regulatory uncertainty was relatively low during 2019. Interestingly, as shown in several Reg Stats charts, federal agencies issued more regulations in 2019 than the previous two years, but the increased flow of regulation was not associated with increased uncertainty. A possible explanation is that the first two years of the administration had provided stakeholders with sufficient information about Trump’s regulatory agenda such that they could form reasonable expectations about incoming changes. In fact, regulatory uncertainty in the middle months of 2020 also maintained a relatively low level compared to the first two years of the Trump presidency.

Regulatory Sentiment under Trump

While policy uncertainty has drawn substantial attention during recent years, sentiment measuring positive and negative attitudes can also provide important economic information. In particular, measures of economic sentiment in the news are strongly correlated with survey-based consumer sentiment measures and comove with aggregate economic fluctuations. In our research, Sinclair and I also found that sentiment about regulation plays a more important economic role than uncertainty about regulation, with negative news about regulation associated with large, persistent drops in future output and employment.

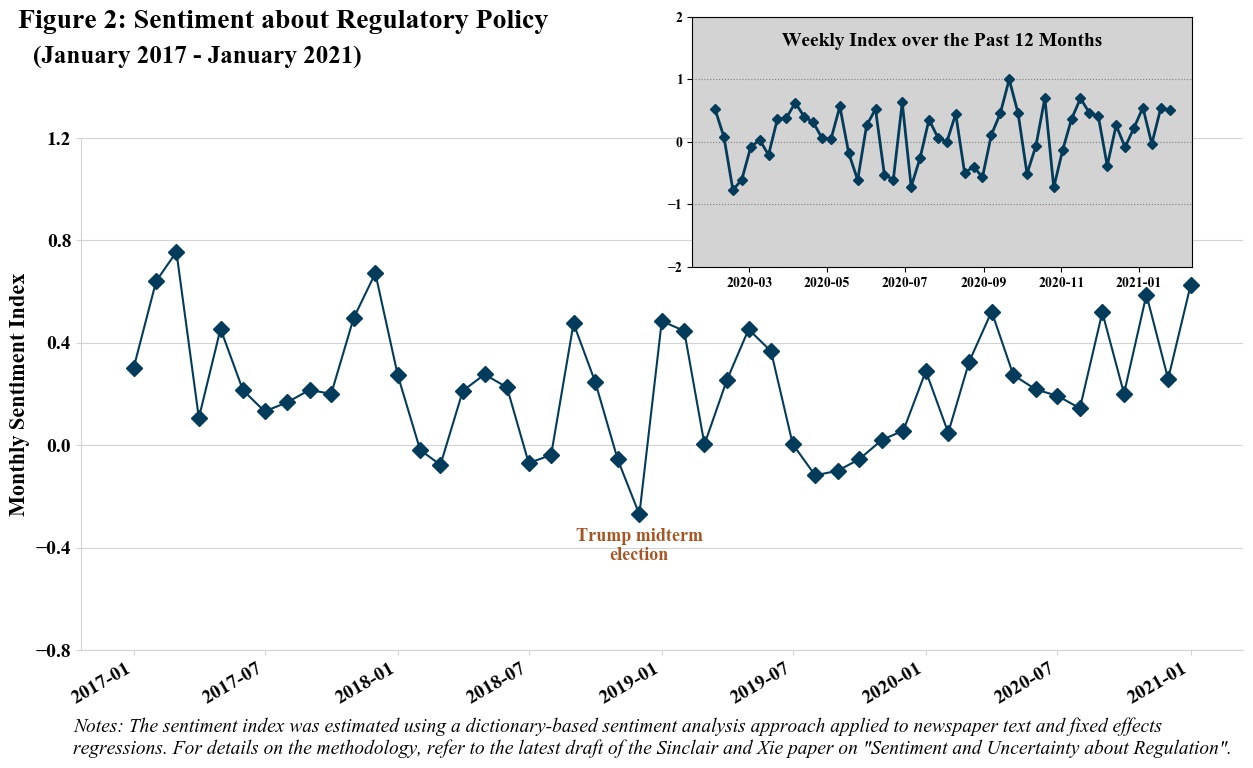

Figure 2 shows the estimated regulatory sentiment index during the past four years. News sentiment about regulation dropped to the lowest point in December 2018 following the midterm elections (specifically, the week of December 10). Some of the news articles at that time with lower sentiment estimates reflect challenges to Trump’s agenda in a divided government after the elections. Other articles, however, cover non-election related issues, such as a December 14 district court ruling declaring the Affordable Care Act (i.e., Obamacare) unconstitutional and DeVos’ failure in restricting an Obama-era rule on student loan forgiveness.

Another interesting observation when comparing regulatory sentiment and uncertainty is that increased uncertainty about regulation can accompany relatively more positive sentiment about regulation. For example, although there was great uncertainty in the beginning of the Trump administration, sentiment expressed in the news contents about regulation was also high, reflecting businesses and investors’ optimism about potential curbs on regulations. Similar patterns were observed in the beginning of the pandemic last year. As I reviewed previously and highlight below by the weekly index in Figure 2, news sentiment about regulation started to improve in mid-March despite the spread of Covid-19 across the country and continuously rising regulatory uncertainty at the same time. Presumably, the public gained more confidence as the government started to take actions through regulation to combat Covid-19 and provide more flexibilities, while it remained unclear how those actions would be implemented, whether they would be effective, and how long they would last.

A Comparison with Previous Administrations

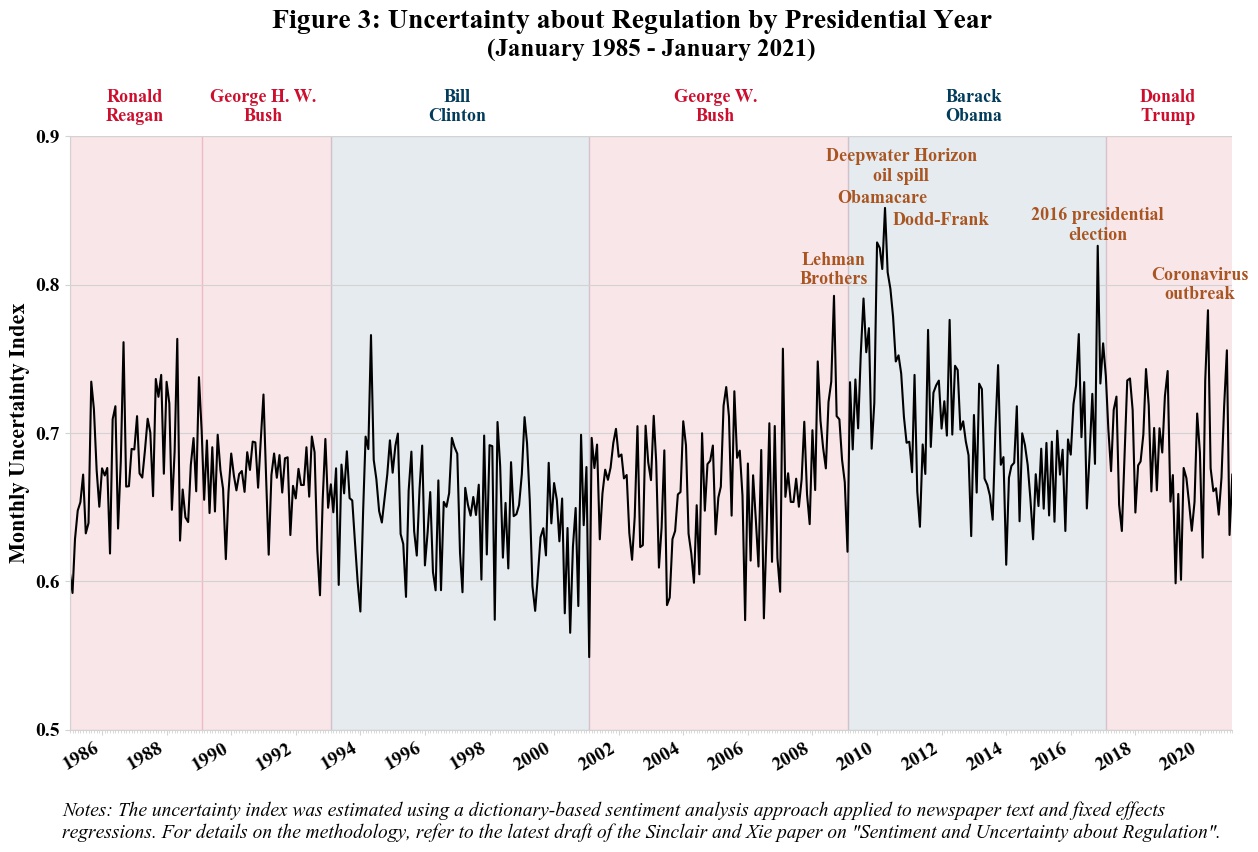

Compared to previous administrations, regulatory sentiment or uncertainty did not experience a particularly high or low period under the Trump administration. Figure 3 shows regulatory uncertainty since the second term of Reagan. A first glance may indicate that regulation under the Obama administration was particularly uncertain. However, the large spikes may be well explained by the 2007-08 financial crisis and post-crisis responses such as the passage of the Dodd-Frank Act. Other salient events that occurred around the same time such as the enactment of Obamacare and the Deepwater Horizon oil spill may also have contributed to the historically high regulatory uncertainty between 2008 and 2010. The surprising 2016 presidential election result triggered another rise in uncertainty at the end of the Obama administration.

Historically, regulatory uncertainty did not vary notably by which party held the White House. The second term of Ronald Reagan appears to be associated with relatively higher uncertainty around regulation than the following administrations. Comparatively, the second term of Bill Clinton and the first term of George W. Bush maintained regulatory uncertainty at a relatively lower level. The Trump administration was not an outlier. Except the increase created by the unexpected coronavirus outbreak, regulatory uncertainty floated within a range similar to the Bush administrations.

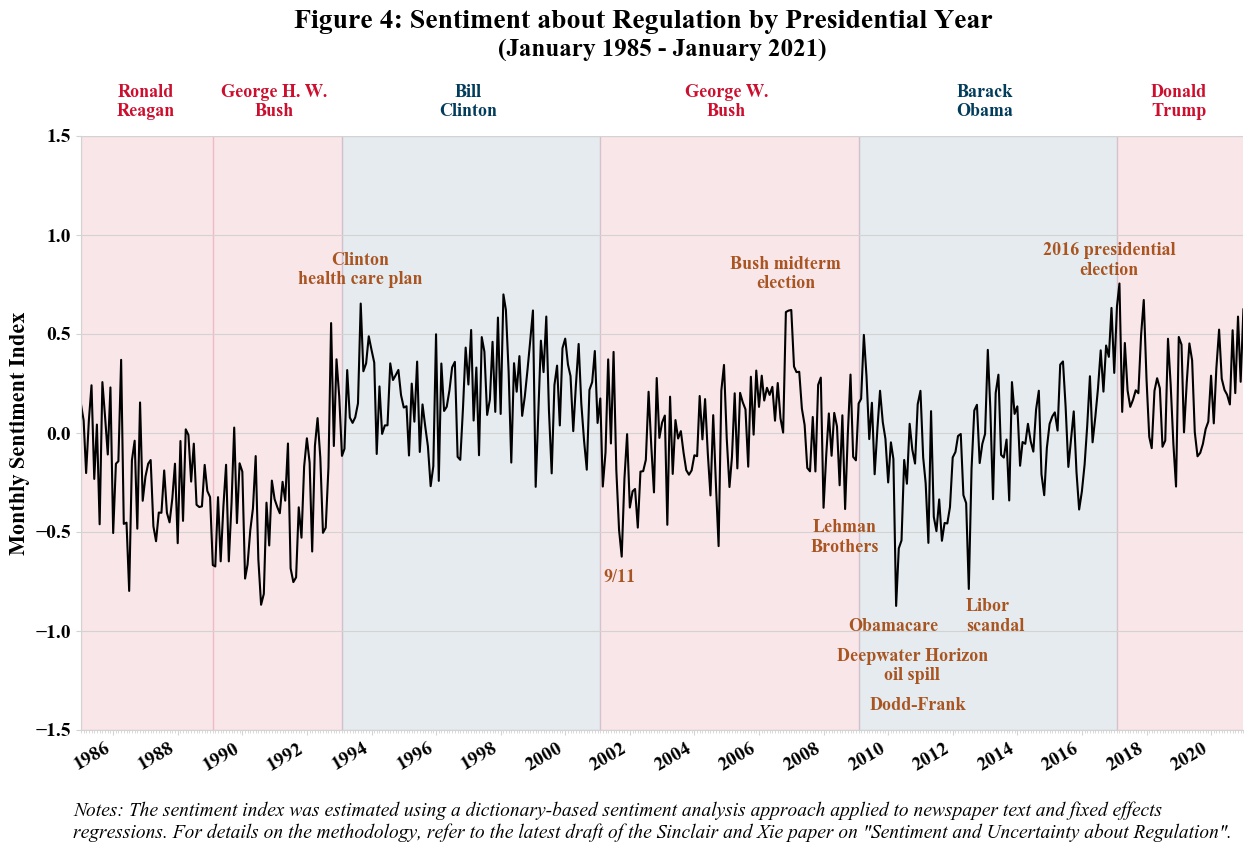

The historical sentiment about regulation shown in Figure 4 demonstrates more variations by president. News contents about regulatory policy generally expressed a relatively more negative tone during the presidency of Ronald Reagan and George H.W. Bush. Comparatively, regulatory sentiment during the Clinton administration was relatively more stable and higher than the other administrations. The sentiment dropped substantially around the 9/11 attack and fluctuated when George W. Bush was in office. Similar to regulatory uncertainty, larger fluctuations in regulatory sentiment were observed during the Obama administration. Overall, regulatory sentiment under the Trump administration was higher than his two predecessors.

What Drives Regulatory Uncertainty and Sentiment?

If minimizing regulatory uncertainty and improving sentiment about regulation are relevant policy goals, what drives regulatory uncertainty and sentiment? Current research is not sufficient to answer this question. However, we can draw some implications from the analysis above.

- Regulatory uncertainty and sentiment are largely affected by political stability and disastrous events. Although we cannot draw any causal relationships from the graphical analysis, we often observe larger fluctuations around salient events. Therefore, a more stable political environment and effective government responses to disastrous events could be particularly helpful for reducing uncertainty and improving public confidence about regulation.

- Regulatory reforms have been focusing on the volume of regulation, but an increased number of regulations does not necessarily increase regulatory uncertainty. Considering what businesses and investors really care about is important.

- Which party occupies the White House is not a major determinant of changes in regulatory sentiment or uncertainty.

- Although we often describe uncertainty as an undesirable attribute, uncertainty can occur around expectations about both good and bad outcomes. That may explain why regulatory sentiment measures provide more relevant economic information than regulatory uncertainty measures.

[1] The seven newspapers are Boston Globe, Chicago Tribune, Los Angeles Times, New York Times, USA Today, Wall Street Journal, and the Washington Post. The newspaper text data are from ProQuest’s TDM Studio (https://about.proquest.com/products-services/TDM-Studio.html).

[2] To assess sentiment, we used the sentiment word lists in the Loughran and McDonald dictionary, the Harvard General Inquirer dictionary, and the Lexicoder Sentiment Dictionary. To assess uncertainty, we used the uncertainty word list in the Loughran and McDonald dictionary.